Press Release

Publisher: Nordex SE

Nordex records first quarter 2020 in line with expectations

• Sales rise to EUR 964.6 million in Q1 2020

• EBITDA margin at 1.4 percent

• Orders of 1.6 GW in Q1 2020

• Order book for projects and services at EUR 8.4 billion

• Guarantee facility refinanced until April 2023

• Guidance for 2020 withdrawn due to COVID-19

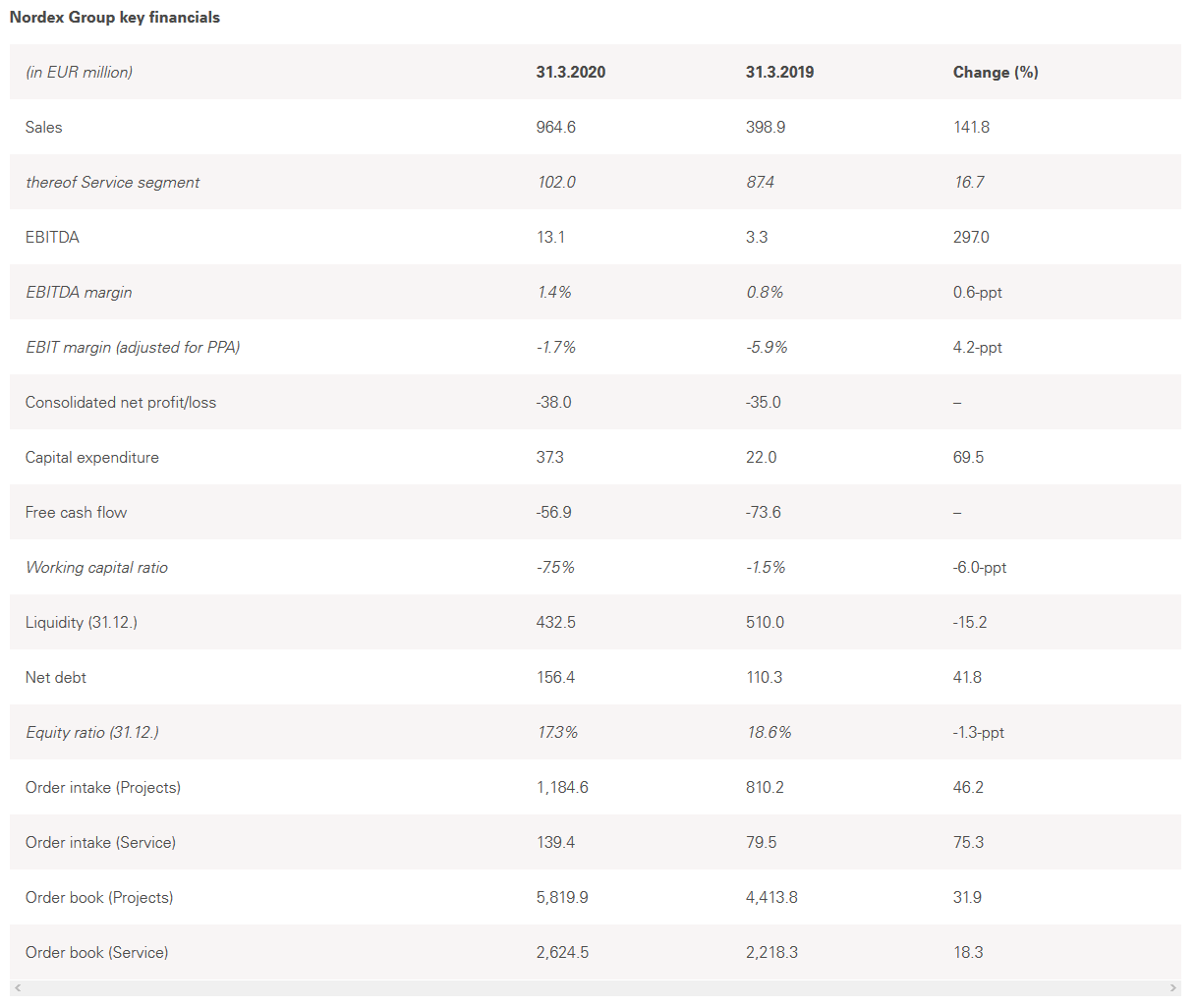

Hamburg (renewablepress) - The Nordex Group (ISIN: DE000A0D6554) confirms the preliminary figures released on 5 May 2020. Sales in the first quarter of 2020 increased to EUR 964.6 million (Q1/2019: EUR 398.9 million). Earnings before interest, taxes, depreciation and amortization (EBITDA) rose to EUR 13.1 million (Q1/2019: EUR 3.3 million), showing an EBITDA margin of 1.4 percent (Q1/2019: 0.8 percent). The increase in sales is mainly attributable to the sharp rise in installation numbers in the Projects segment.

Operating performance

In the first quarter of 2020, the Nordex Group installed a total of 269 wind turbines (Q1/2019: 84) in 21 countries with a combined output of 899.2 MW (Q1/2019: 260.9 MW). Europe accounted for 60 percent of the installed capacity, Latin America for 15 percent, North America for 13 and the Rest of the World for 12 percent. As a result, sales for the Projects segment climbed to EUR 862.6 million in the reporting period (Q1/2019: EUR 312.3 million). Sales in the Service segment also continued to grow, rising by 16.7 percent from EUR 87.4 million to EUR 102.0 million.

Turbine assembly rose from 698 MW in the prior-year quarter to 1,641 MW in the first three months of 2020. The number of rotor blades produced by the Company was up marginally on the prior-year figure, rising to 321 from 300 units in the same quarter of the previous year. The Nordex Group's production is always aligned with the delivery obligations associated with the projects.

In the first three months of 2020, the Nordex Group increased its order intake in the Projects segment (i.e. excluding services) to 1,643.9 MW (Q1/19: 1,035.1 MW); this corresponds to a value of EUR 1,184.6 million (Q1/19: EUR 810.2 million). At 1,292 MW, the order volume in Europe was particularly high, making up nearly 79 percent overall. Latin America accounted for 352 MW or 21 percent. The strongest individual markets were Norway, Chile, the United Kingdom, Turkey and Finland. At the end of the first quarter of 2020, the Nordex Group’s order book in the Projects segment had a value of EUR 5.8 billion (31 March 2019: EUR 4.4 billion), while its order book in the Service segment had a value of EUR 2.6 billion (31 March 2019: EUR 2.2 billion).

Key financial figures at a glance

Total assets increased only slightly compared with the end of the year. The equity ratio was 17.3 percent (31 December 2019: 18.6 percent). Net debt amounted to EUR 156.4 million (31 March 2019: EUR 110.3 million) and the working capital ratio as a percentage of consolidated sales was at minus 7.5 percent (31 March 2019: minus 1.5 percent).

Guarantee facility refinanced until 2023

In April, the Nordex Group also successfully refinanced its EUR 1.21 billion guarantee facility. The guarantee facility provided by consortium of 21 banks and insurers allows the Nordex Group to secure its project business with customers with customary bank guarantees in the respective main currencies. This guaranteed credit facility is tied to ESG criteria and has been certified as sustainable.

Guidance for 2020 withdrawn due to COVID-19

As a global company, the Nordex Group relies on a global supply chain with appropriate procurement processes. Production, logistics and installations are closely integrated to ensure efficient completion of the international projects. The Covid-19 pandemic led to numerous restrictions and measures being imposed by governments and public authorities that are still in place. This caused major interruptions in the Nordex Group and led to adjustments being made in important parts of the business such as procurement and production. Given the continued uncertainty about how long the interruptions will last and the current difficulty in estimating any further consequences for the supply chain, production and completion of projects (installations), it is no longer possible to give a reliable and realistic assessment of Nordex SE’s future business performance. For this reason, the Management Board of Nordex SE decided to withdraw its guidance for financial year 2020. The original guidance was published on 24 March 2020 in the 2019 Annual Report and was subject to possible impacts by the Covid-19 pandemic. Owing to the current situation and the uncertainty surrounding its duration, it is not possible to predict with any certainty when a new guidance for financial year 2020 will be available.

“We started the year as expected and recorded continuous, strong demand for our wind turbines from the Delta4000 series, which make up 85 percent of the 1.6 GW. In the last few days of the quarter, we began to feel the effects of the Covid-19 pandemic. This led to repeated interruptions in our supply chain and in production that are still continuing. Because a realistic and reliable assessment for financial year 2020 is no longer feasible, we have withdrawn our guidance,” said Nordex SE CEO José Luis Blanco. “Our top priority is safeguarding the health of our employees and business partners. We are also working hard to maintain our supply chain and our production and to process our customers’ projects as well as we can despite all the uncertainties.”

The complete report for the first quarter of 2020 is now available for download on the Nordex Group's website in the Investor Relations section under "Publications" (ir.nordex-online.com). The Group interim management report and the condensed interim consolidated financial statements were neither audited nor reviewed by an auditor.

Download press photo:

https://www.renewablepress.com/press-images/nordex/49de0_DJI_0159.jpg

https://www.renewablepress.com/press-images/nordex/49de0_DJI_0159.jpg© Nordex SE

Nordex Group key financials:

https://www.renewablepress.com/press-images/nordex/9b756_key-financials-Nordex-q1-20-110520.png

https://www.renewablepress.com/press-images/nordex/9b756_key-financials-Nordex-q1-20-110520.png© Nordex SE

Hamburg, 11 May 2020

Publication and Reprint free of charge; please send a voucher copy to Nordex SE.

Attention editorial offices - For further questions please contact:

Media contact:

Nordex SE

Felix Losada

Phone: +49 (0)40-30030–1000

E-Mail: flosada@nordex-online.com

Contact for investors:

Nordex SE

Felix Zander

Phone: +49 (0)40-30030–1000

E-Mail: fzander@nordex-online.com

Nordex SE

Langenhorner Chaussee 600

22419 Hamburg

Internet: https://www.nordex-online.com

Online press kit - all press releases from DE813076467

Press photos for editorial use only

Note: For the content of this press release the issuer / publisher of the release is »DE813076467« responsible.

The press release "Nordex records first quarter 2020 in line with expectations" von DE813076467 is also available in the following languages:

More press releases from Nordex SE

- Nordex Group wins multiple European contracts totalling 220 MW in January 2026

- Nordex Group receives 56 MW order for community wind farm in Schleswig-Holstein, Germany

- Nordex Group secures 189 MW order from OX2 in Sweden

- VERBUND Green Power and Nordex Group sign multi-year framework agreement for supply of wind turbines totalling 700 MW

- In 2025, the Nordex Group accounted for approx. 32% of new onshore wind turbine installations (MW) in Germany

- Nordex Group closes Q4 with 3.6 GW in orders, setting a new annual order intake record of 10.2 GW in 2025

- Nordex Group secures new orders totalling 246 MW in Spain

- Nordex obtains orders for 414 MW in France, Belgium and Portugal

- Nordex Group receives orders from UKA totaling 224 MW for projects in Germany

- The Nordex Group receives orders totalling 508 MW in Canada, including a first order for the N175/6.X turbines

About Nordex SE

The development, manufacture, project management and servicing of wind turbines in the onshore segment has been the core competence and passion of the Nordex Group and its more than 7,900 employees worldwide since 1985. As one of the world's largest wind turbine manufacturers, the Nordex Group offers high-yield, cost-efficient wind turbines under the Acciona Windpower and Nordex brands that enable long-term and economical power generation from wind energy in all geographical and climatic conditions.

The focus is on turbines in the 3 to 5MW+ class, and the Group’s comprehensive product portfolio offers individual solutions for both markets with limited space and regions with limited grid capacities. With more than 29 GW of installed capacity worldwide, Nordex Group systems deliver sustainable energy throughout more than 80 per cent of the world’s energy market (excluding China).

Nordex SE is listed on the TecDAX of the Frankfurt Stock Exchange. The management holding company is headquartered in Rostock, while the executive board and administrative offices are based in Hamburg. At production facilities in Germany, Spain, Brazil, the US, and India, the Nordex Group produces its own nacelles, rotor blades and concrete towers. The Group also maintains offices and branches in more than 25 countries.

Press contact at Nordex SE

Felix Losada

Mail: flosada@nordex-online.com

Phone: +49 (0)40 - 300 30 - 1141